In the unpredictable world of financial markets, safe-haven assets serve as a shield against economic turbulence. These assets are the go-to options for traders and investors looking to safeguard their portfolios during times of market volatility or downturns. In this guide, we’ll explore what safe-haven assets are, why they matter, and how you can trade them effectively to protect your investments.

What Are Safe-Haven Assets?

Safe-haven assets are financial instruments that tend to retain or even increase in value during periods of economic instability or market downturns. They act as a refuge for investors seeking to minimize losses when traditional growth assets, like equities, decline. Historically, assets such as gold, the Japanese Yen (JPY), US Treasuries, and certain defensive stocks have proven to be reliable safe havens.

These assets typically share several key characteristics:

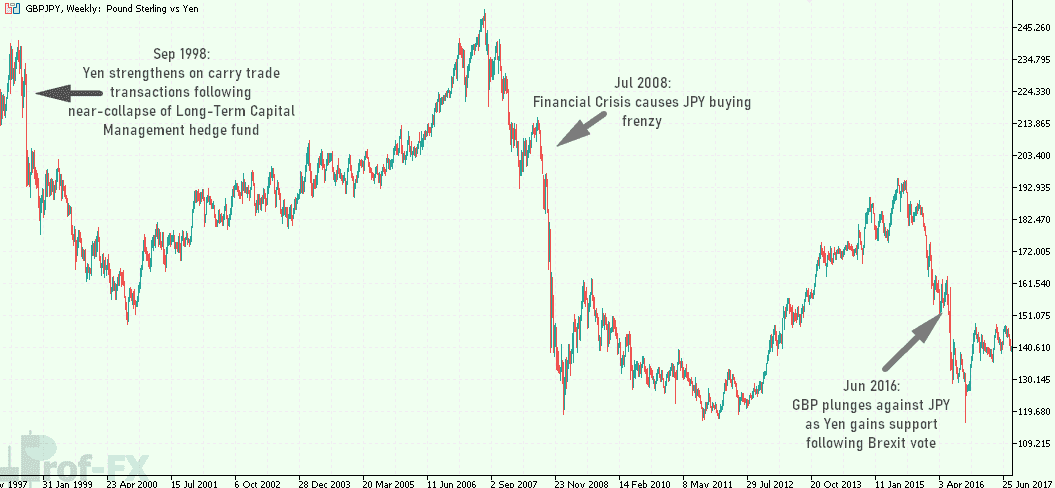

1.High Liquidity: Safe-haven assets are often highly liquid, meaning they can be easily bought or sold without significantly affecting their price. For example, the GBP/JPY currency pair is known for its liquidity, making it a popular choice during times of market stress.

2. Limited Supply: Scarcity drives value. Assets like gold, which have a finite supply, tend to hold their worth better during economic crises. When demand rises, their value often increases.

3. Varied Utility: Assets with diverse applications, such as copper in infrastructure or silver in industrial processes, tend to maintain demand even during downturns.

4. Enduring Demand: True safe havens are expected to remain in demand over the long term. For instance, gold’s timeless appeal ensures its relevance across generations.

5. Permanence: Assets that don’t deteriorate over time, like precious metals, are more likely to retain their value.

Top Safe-Haven Assets to Trade

Here are some of the most popular safe-haven assets traders turn to during uncertain times:

1. Gold

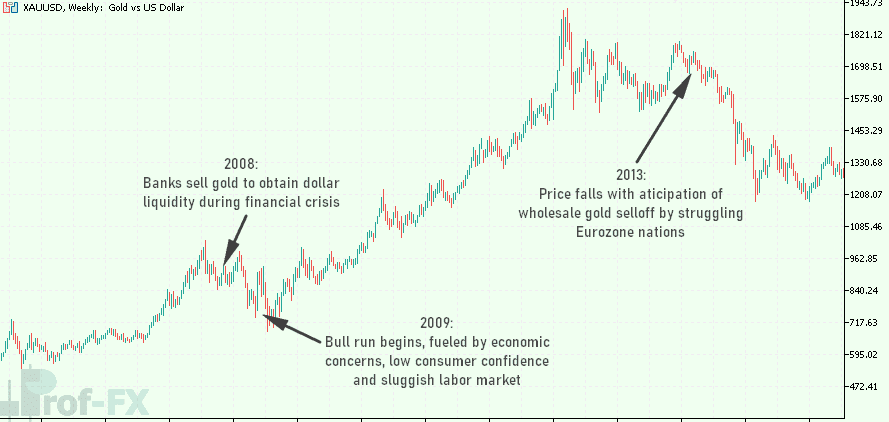

Gold is the quintessential safe-haven asset. Its value often moves inversely to stock markets, making it a reliable hedge during downturns. For example, during the 2008 financial crisis, gold prices surged as investors sought stability. By 2011, gold reached an all-time high of $1,900 per ounce, solidifying its reputation as a safe haven.

2. Japanese Yen (JPY)

The Japanese Yen is a favorite among forex traders during market turmoil. Japan’s trade surplus, its status as a net creditor nation, and its role in carry trades contribute to its safe-haven appeal. Historical charts show JPY strengthening during periods of global uncertainty.

3. Defensive Stocks

While growth stocks often falter during economic downturns, defensive stocks in sectors like consumer goods and utilities tend to perform well. Companies like McDonald’s have demonstrated resilience during challenging economic times, making them a reliable choice for investors.

4. US Treasuries

US Treasuries are considered one of the safest investments due to the backing of the US government. These debt securities are repaid upon maturity, making them a low-risk option for investors seeking stability.

How to Trade Safe-Haven Assets

Trading safe-haven assets requires a combination of market analysis and timing. Here’s how you can approach it:

1. Monitor Economic Indicators: Keep an eye on key economic data such as employment statistics, GDP growth, and consumer confidence. These indicators can signal potential downturns, prompting you to shift your portfolio toward safe havens.

2. Watch for Inverted Yield Curves: An inverted yield curve for US Treasuries has historically preceded recessions. While not a guarantee, it’s a strong warning sign.

3. Use Technical Analysis: Tools like the Relative Strength Index (RSI) can help identify overbought or oversold conditions, guiding your entry and exit points.

4. Study Historical Trends: While safe-haven assets are generally reliable, there are exceptions. For instance, during the 2008 financial crisis, gold initially dipped as banks liquidated assets for cash. Understanding these nuances can help you make better-informed decisions.

For more in-depth strategies on trading safe-haven currencies and stocks, check out our detailed forex guides. Whether you’re navigating choppy markets or planning for long-term stability, understanding safe-haven assets is crucial for every trader.