Understanding Price Action and Its Role in Forex Trading

Technical analysis involves interpreting the price chart to make informed trading decisions. While it might seem daunting at first, let’s break it down.

The price chart captures all price fluctuations over a given period, reflecting market sentiment during that time. When positive news about an asset emerges, its price often rises to account for the bullish sentiment. Conversely, negative news can lead to a decline in price. However, future events remain unknown and are not yet reflected in the chart.

Technical analysts operate on the premise that a price chart represents the collective sentiment of all available information about an asset at any given moment. Yet, interpreting price movements can often seem chaotic and unpredictable.

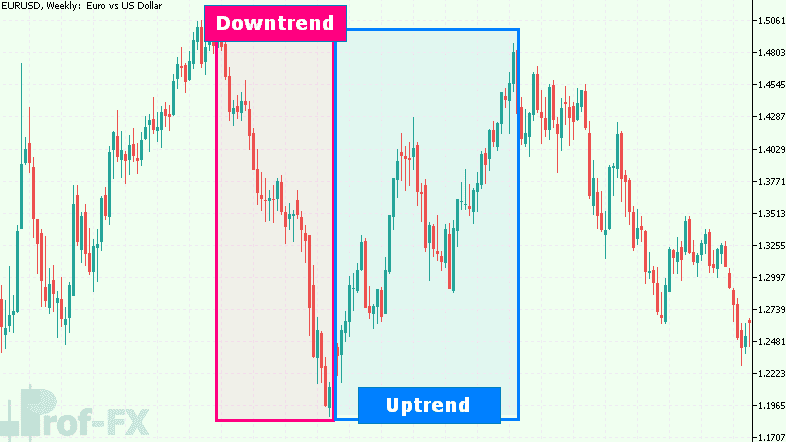

For example, consider a weekly chart of the EUR/USD currency pair, which might show uptrends, downtrends, and periods of congestion—all of which could confuse even seasoned traders. For those new to forex, our Forex Courses offers helpful guidance.

The Role of Indicators in Simplifying Analysis

Technical Indicators, derived from historical price data, help traders make sense of market movements. With a myriad of indicators available, traders often experiment to find what works best for their strategy. However, one crucial principle remains: no indicator or trading system works flawlessly 100% of the time.

Since future price action is inherently unpredictable, relying solely on past data can be limiting. This is where price action analysis—using the raw price chart without any indicators—comes into play.

Identifying Trends: A Key to Strategic Trading

Many traders aim to tilt the odds in their favor by identifying trends. The assumption is that recent price biases might persist. For instance, in a downtrend, traders might focus on short positions, while in an uptrend, they might favor long positions.

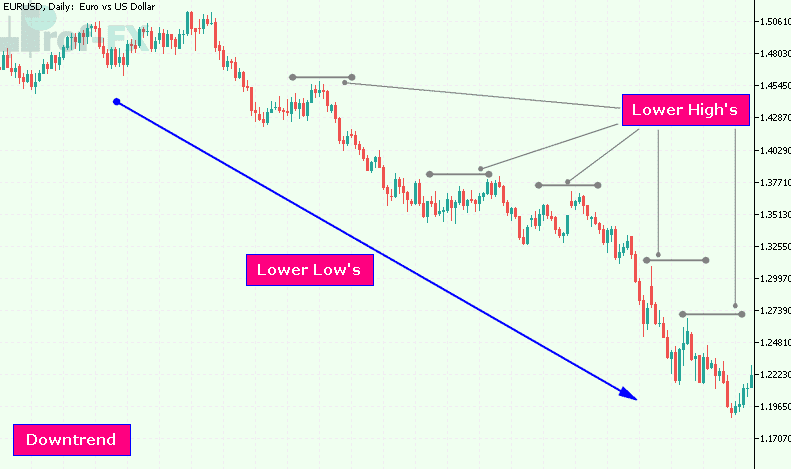

Let’s revisit the weekly EUR/USD chart, this time highlighting two distinct trend sections.

These trends are discernible without any indicators, relying solely on the price chart. During the downtrend, price movements were not linear but characterized by significant declines, followed by periods of congestion, and then further declines.

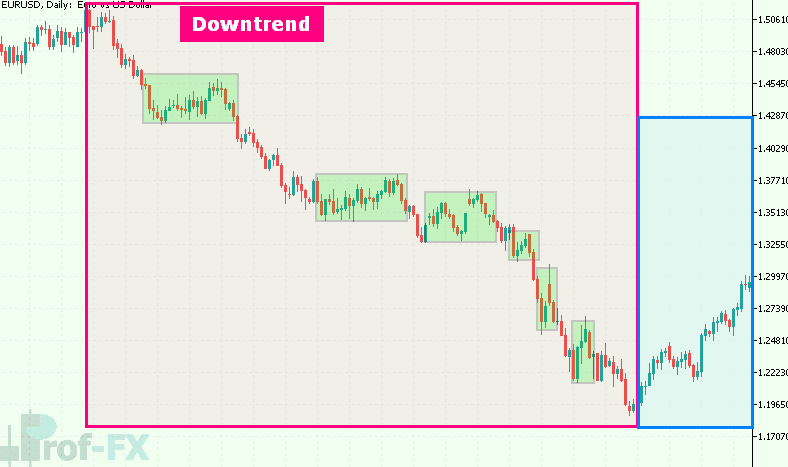

Now, let’s zoom in on a daily time frame of the same chart.

Each shaded box marks periods of congestion within the downtrend. From a high above 1.50, the currency pair experienced rapid declines, followed by intervals of counter-trend movements. However, these counter-trends were temporary, and the downtrend eventually resumed, reaching even lower levels.

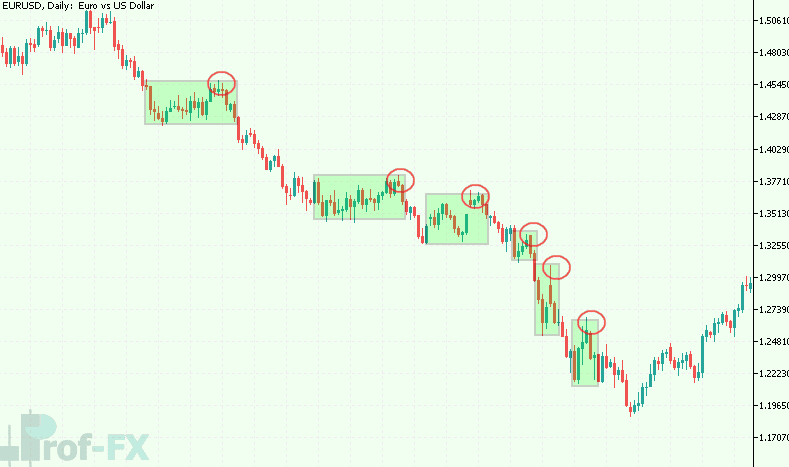

In these congestion periods, price swings become evident. Below is the EUR/USD chart with swing highs circled in red.

Spotting Consistent Patterns in Swing Highs and Lows

Notice a recurring pattern: each swing high occurs at a lower price than the previous one. These lower highs and lows confirm a downtrend.

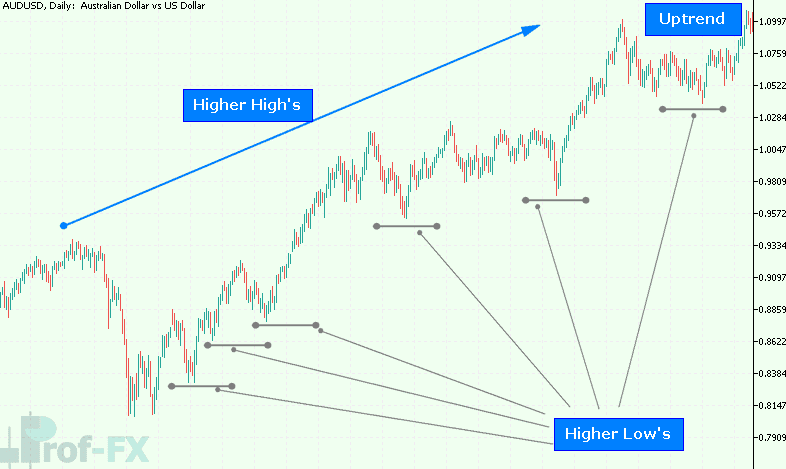

The same principles apply to identifying uptrends, with higher highs and higher lows.

In upcoming articles, we’ll explore specific tools and techniques to enter trades aligned with prevailing trends.

Mastering chart analysis is essential for forex trading. Understanding candlestick, bar, and line charts is crucial for making informed decisions. For more information, visit our Introduction to Charting page, which provides foundational knowledge for analyzing forex charts effectively.