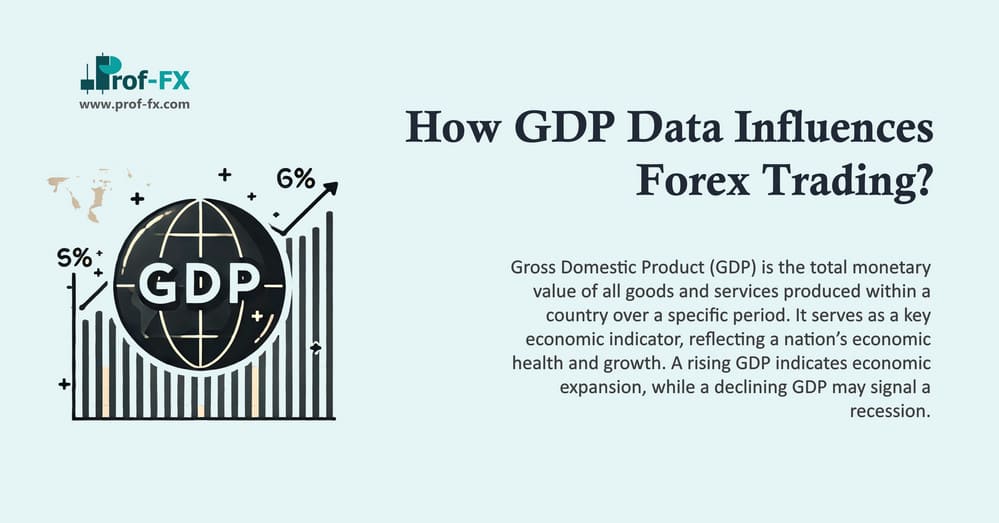

Economic growth announcements report on how well a country’s economy is doing. Economies can move in one of three directions: they can be growing, they can be stagnating, or they can be contracting. When an economy is growing, everything within the economy is able to function normally and profitably. When an economy is stagnating or contracting, however, all sorts of problems start to emerge, and the country’s currency typically suffers.

Economic growth data are released in one key announcement that you need to watch:

Gross domestic product (GDP): Measurement of the total economic output of a country

Impact on Trade Flows

Expanding Economy -> More Money in Consumers’ Pockets -> Increased Demand for Imports

Contracting Economy -> Less Money in Consumers’ Pockets-> Decreased Demand for Imports

Impact on Investment Flows

Expanding Economy -> Profitable Companies Bullish Stock Market Increased Investment Flows

Expanding Economy -> Rising Inflation –÷ Higher Interest Rates Attractive Government Debt Market -> Increased Investment Flows

Contracting Economy -> Struggling Companies ->Bearish Stock Market ->Decreased Investment Flows

Contracting Economy -> Falling Inflation -> Lower Interest Rates -> Less Attractive Government Debt Market ->Decreased Investment Flows

Impact on Money Supply

Expanding Economy —> Central Bank Raising Interest Rates to Prevent the Economy From Overheating –> Decrease in the Money Supply

Contracting Economy —> Central Bank Lowering Interest Rates to Stimulate the Economy —> Increase in the Money Supply

Impact on Investor Fear

Expanding Economy —> Confident Investors

Contracting Economy —> Nervous Investors

Typical Impact on the Currency

Expanding Economy -> Stronger Currency

Contracting Economy —> Weaker Currency