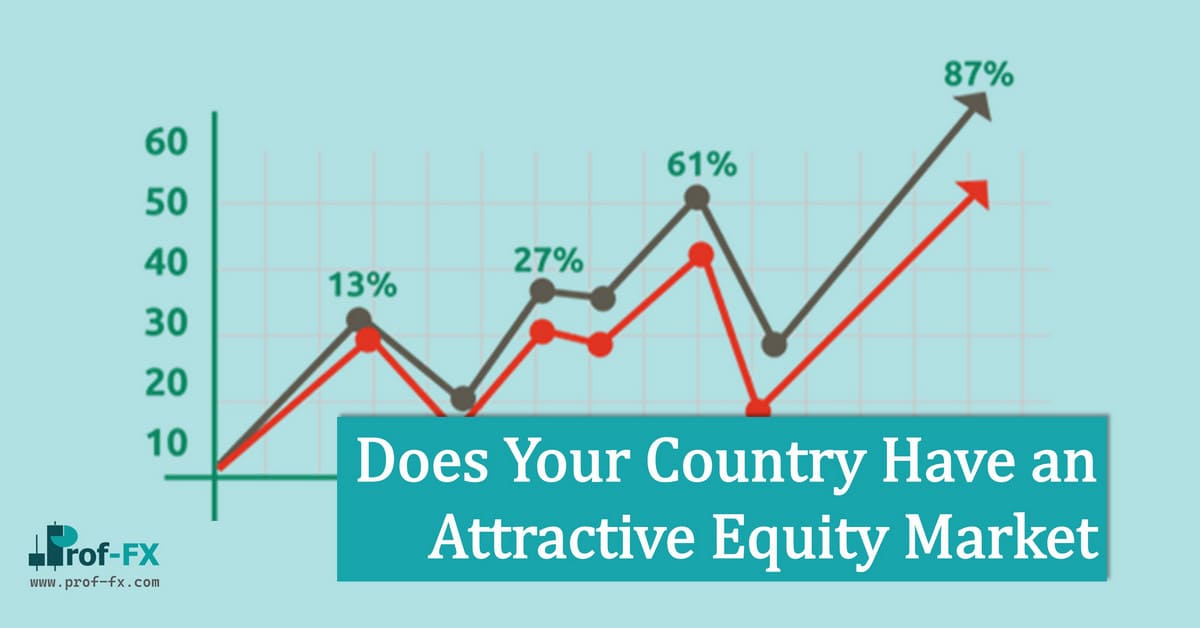

Why do we care if a country has an attractive equities market? We care because countries with attractive equities markets tend to draw a lot of foreign investment.

As investment flows increase, demand for the currency goes up and the value of the currency typically moves higher.

When investors evaluate a country’s equities market, they are weighing two important questions:

- How risky is the market?

- What yield can I expect on my investments?

Risk in the equities market is driven by many different factors. The size of the market is vitally important. A huge, developed stock market like the one we enjoy in the United States is going to provide a safer investment environment than a small, fledgling stock market will.

Large equities markets tend to have lots of investors, lots of different stocks for investors to choose from, and a lot of liquidity.

Large equities markets also tend to be more effectively regulated.

For instance, the reporting requirements that a company must meet if it is to be listed on the New York Stock Exchange (NYSE) are far more thorough than the reporting requirements for a company that is listed on the Botswana Stock Exchange (BSE).

The more accurate the information that investors are able to receive regarding the companies that they are about to invest in, the more confident they will be about investing larger sums of money in those stocks.

Naturally, traders weigh how risky an equities market is against the potential profit that they believe they can receive by investing their money in that market. If an equities market is generating higher returns, it will warrant a higher level of risk.

Conversely, if an equities market is generating lower returns, it will not warrant a higher level of risk. Ideally, investors are looking for stable equities markets that are offering high yields on investment.