The ISM Manufacturing Index is a cornerstone of forex trading, offering critical insights into global economic activity and influencing currency prices worldwide. For forex traders, understanding the ISM manufacturing, construction, and services indicators is not just beneficial—it’s essential. These monthly data releases provide unique trading opportunities, making it crucial to know how to interpret and prepare for them.

What is ISM Data?

The Institute for Supply Management (ISM) is a globally recognized organization that tracks economic activity across manufacturing and services sectors. Established in 1915, ISM is the world’s first management institute, with members spanning over 300 countries. Its monthly data releases, which include metrics like production levels and new orders, are derived from surveys of purchasing managers. These professionals provide real-time insights into supply chain dynamics, making ISM data a reliable barometer of economic health and a key driver of currency price movements.

ISM Surveys: A Closer Look

ISM publishes three primary surveys each month: manufacturing, construction, and services. The ISM Purchasing Managers Index (PMI), a composite index based on surveys of 400 manufacturing purchasing managers, is particularly influential. It evaluates five critical areas:

- Inventories

- Employment

- Supplier Delivery Speeds

- Production Levels

- New Customer Orders

The manufacturing PMI is released on the first business day of the month, followed by construction on the second day and services on the third. Forex traders closely monitor these releases to assess market risks and identify potential trading opportunities.

How ISM Data Impacts Forex Markets

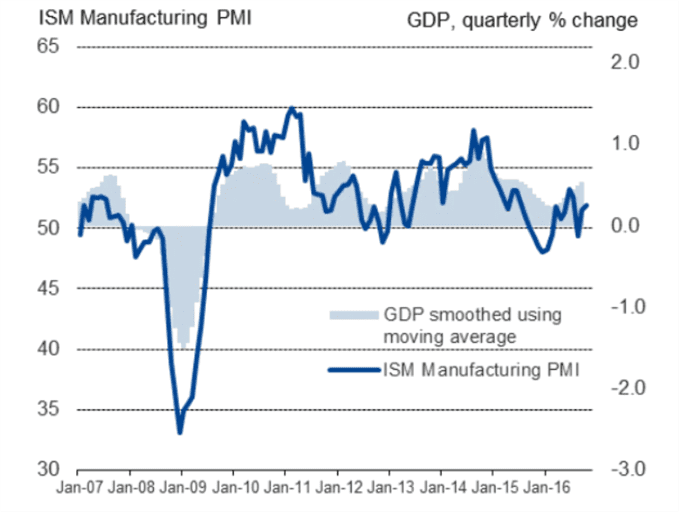

The ISM Manufacturing and Non-Manufacturing PMIs are significant market movers. Released at 10:30 AM ET, these reports often trigger currency volatility. Since the data reflects the previous month’s economic activity, sourced directly from industry professionals, it provides a snapshot of whether the U.S. economy is expanding or contracting. This makes ISM data comparable in importance to other major economic indicators like Non-Farm Payrolls (NFP).

Currencies react sharply to ISM releases because they serve as a gauge of U.S. economic health. A strong PMI reading typically boosts the U.S. dollar, while a weak reading can lead to a sell-off.

How Forex Traders Use ISM Data

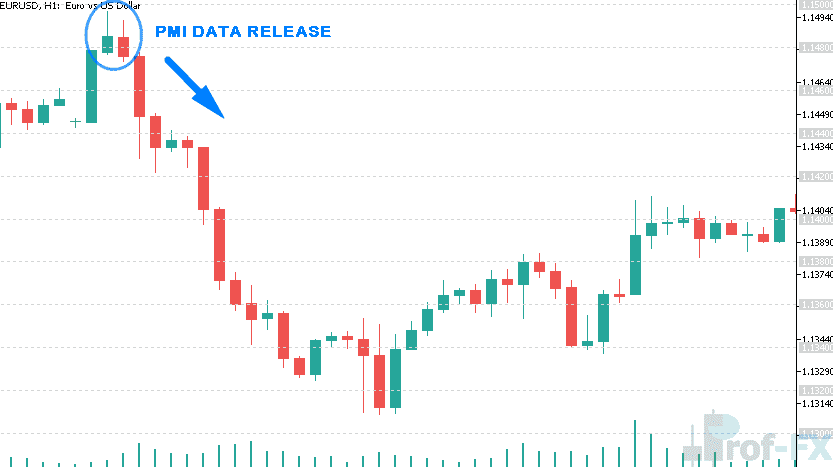

Forex traders analyze ISM data by comparing the actual release with both the previous month’s figure and economists’ forecasts. If the PMI exceeds expectations and shows improvement over the prior month, the U.S. dollar often rallies. This is where fundamental and technical analysis converge, creating actionable trade setups.

For example, a better-than-expected ISM Manufacturing PMI can trigger a sharp rise in the U.S. dollar against other currencies. In one instance, the EUR/USD pair dropped 150 pips within hours after the ISM Manufacturing PMI came in at 54.9, surpassing both the previous month’s figure and market forecasts. Such movements highlight the importance of ISM data in forex trading.

Key Scenarios for Forex Traders

- Strong PMI Data: A PMI above 50 indicates economic expansion, often leading to a stronger U.S. dollar.

- Weak PMI Data: A PMI below 50 signals economic contraction, potentially weakening the dollar.

- In-Line Data: If the PMI matches forecasts or remains unchanged, the market may show little reaction.

Notably, if the PMI remains below 50 for two consecutive months, the economy is considered to be in a recession. This makes ISM data a critical tool for traders assessing long-term economic trends.

Beyond the U.S.: Global PMIs

While ISM compiles U.S. PMIs, the Eurozone relies on the Markit Group for its PMI data. Traders often compare these regional indicators to identify cross-currency opportunities. For instance, a weak U.S. ISM Non-Manufacturing PMI might lead to a dollar sell-off, boosting the Euro as capital flows into Eurozone markets.

Conclusion: Why ISM Data Matters

The ISM Manufacturing Index is more than just a number—it’s a powerful tool for forex traders. By providing real-time insights into economic health, ISM data helps traders anticipate currency movements and make informed decisions. Whether you’re a beginner or an experienced trader, understanding ISM data is key to navigating the forex market.