Forex traders keep a close watch on the economic calendar because they know that economic announcements provide the data that analysts and traders use to develop their outlooks on where they believe currency values are going to move in the future.

The nice part about the economic calendar is that the announcements are scheduled months in advance, so that everybody knows precisely which announcements are going to be released and when each announcement is going to be made. For instance, the U.S. government doesn’t just decide one morning that it needs to announce the unemployment rate for the previous month. Instead, it develops a schedule and makes sure that everyone is aware of that schedule. After all, there are enough surprises that come out of these economic announcements. We don’t need to be surprised by the timing as well.

If you take a look at any economic calendar, you will see announcements ranging from central bank interest rates to natural gas storage levels. Naturally, some economic announcements are more important than others. So to help you identify what you should be paying the most attention to, we will be covering the following announcements:

- Interest rates

- Employment

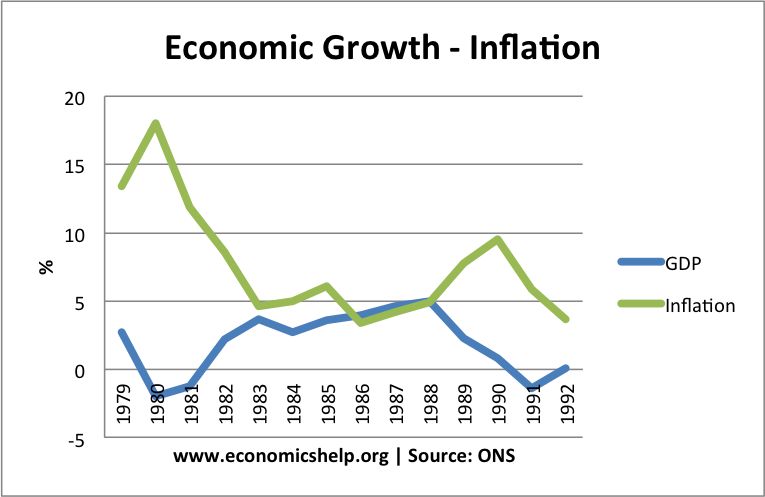

- Inflation

- Economic growth (GDP)

- Trade balance

- Foreign investment

- Consumer confidence

- Retail sales

- Business confidence

- Manufacturing

- Housing

Knowing which announcements to pay attention to is only half of the equation. You also need to know what you are looking for when you analyze an announcement. When you evaluate any economic announcement, you should be asking yourself how the announcement will affect expectations for the following five drivers of currency prices:

- Trade flows

- Investment flows

- Money supply

- Investor fear

- Government interventions

Unfortunately, there is no cut-and-dried method for calculating the impact that an economic announcement will have on any one of these five price drivers. When evaluating economic announcements, there is always room for interpretation. With that in mind, we are going to outline a few scenarios for each announcement to help you better understand the linear thought process that you need to go through when you analyze an announcement. The scenarios will walk through a series of cause-and-effect relationships that will look like this:

Rising Interest Rates —> Increased Investment Flows –>Increased Demand for the Currency –> Increase in Value of the Currency —> Less Competitive Exports —> Decrease in Trade Flows

The “—>” in these cause-and-effect relationships is shorthand for the phrase “lead(s) to” or “which leads to.” So you would read the previous relationship as follows: rising interest rates lead to increased investment flows, which leads to increased demand for the currency, which leads to an increase in the value of the currency, which leads to less competitive exports, which ultimately leads to a decrease in trade flows.

Now that we know what we’re looking for, let’s get familiar with the major economic announcements that are going to be part of your Forex investing life from here on out. One thing you will notice as we go through this section is that it is fairly U.S.-centric. However, most of the concepts apply universally across various countries. And one more thing: if you have an economic calendar that you already use and are happy with, that’s great. However, if you are interested in checking out some different calendars, here are a few that we think are worthy of your time:

- Forex Factory: www.Forexfactory.com/calendar.php (our personal favorite)

- FX Street: www.fxstreet.com/nou/continguts/economicalcal.asp